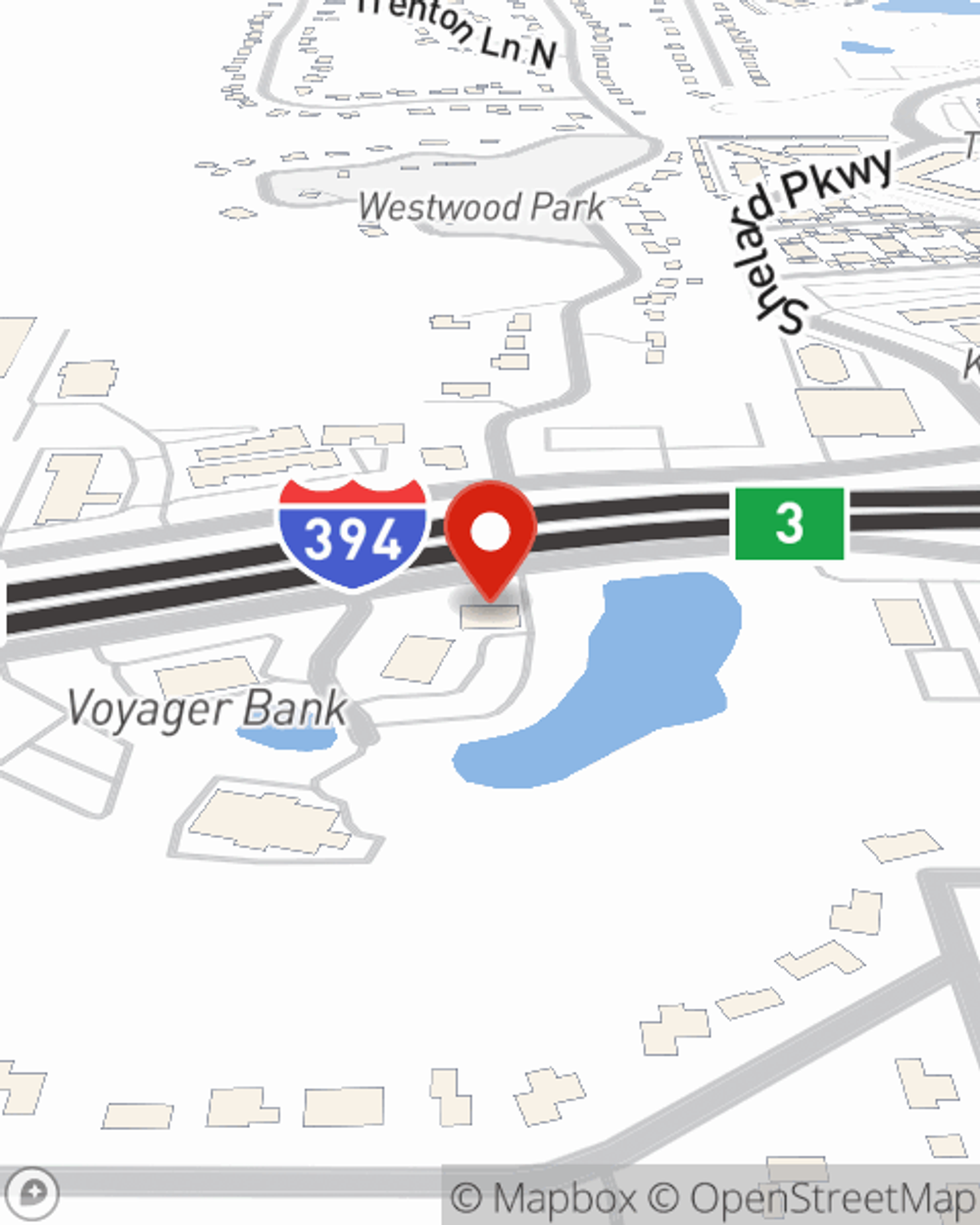

Homeowners Insurance in and around Minnetonka

Looking for homeowners insurance in Minnetonka?

The key to great homeowners insurance.

Would you like to create a personalized homeowners quote?

What's More Important Than A Secure Home?

Everyone knows having fantastic home insurance is essential in case of a fire, ice storm or blizzard. But homeowners insurance is about more than covering natural disaster damage. An additional feature of home insurance is its ability to protect you in certain legal situations. If someone is injured at your residence, you could be required to pay for the cost of their recovery or their medical bills. With enough home coverage, your insurance may cover those costs.

Looking for homeowners insurance in Minnetonka?

The key to great homeowners insurance.

Safeguard Your Greatest Asset

With this terrific coverage, no wonder more homeowners prefer State Farm as their home insurance company over any other insurer. Agent Marty Mjelleli would love to help you choose the right level of coverage, just visit them to get started.

As a dependable provider of home insurance in Minnetonka, MN, State Farm helps you keep your valuables protected. Call State Farm agent Marty Mjelleli today for a free quote on a home policy.

Have More Questions About Homeowners Insurance?

Call Marty at (952) 546-6111 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

How to get rid of nuisance deer

How to get rid of nuisance deer

Nuisance deer can cause major property damage. Learn tips for deterring deer, such as using repellents, fencing, scare tactics, and deer resistant plants.

How to shut off utilities in an emergency

How to shut off utilities in an emergency

Don't wait until an emergency happens to learn how to shut off utilities. Here are some tips for familiarizing yourself with the process now.

Marty Mjelleli

State Farm® Insurance AgentSimple Insights®

How to get rid of nuisance deer

How to get rid of nuisance deer

Nuisance deer can cause major property damage. Learn tips for deterring deer, such as using repellents, fencing, scare tactics, and deer resistant plants.

How to shut off utilities in an emergency

How to shut off utilities in an emergency

Don't wait until an emergency happens to learn how to shut off utilities. Here are some tips for familiarizing yourself with the process now.